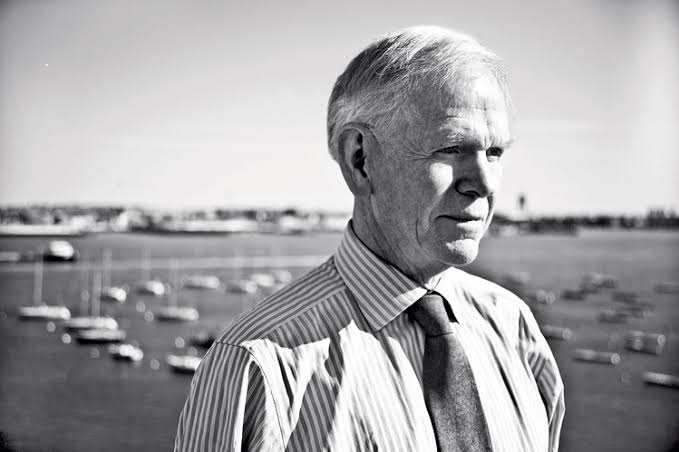

Renowned investor and stock market historian, Jeremy Grantham, has expressed his belief in an upcoming US recession.

Grantham, known for accurately predicting previous financial crises, does not have confidence in the Federal Reserve’s ability to steer the economy towards a soft landing. He argues that higher interest rates will cause pain in the markets and expects the repercussions to drag on, potentially sparking a recession that could last into 2024.

Grantham also warns of a possible stock market decline accompanying the downturn. In April, he predicted a significant market decline and a brutal recession, advising against holding US stocks and criticizing the Federal Reserve for creating asset bubbles.

Furthermore, Grantham suggests that Federal Reserve Chair Jerome Powell’s goal of 2% inflation may be challenging to achieve. He believes that we have entered a period of moderately higher inflation and, consequently, moderately higher interest rates. Grantham states that low rates push asset prices up, while higher rates push them down, and he anticipates an era of higher rates compared to the previous decade.

In summary, Jeremy Grantham’s insights highlight his concerns about an impending US recession and doubts about the Federal Reserve’s ability to effectively manage the situation. He warns of the negative impact of higher interest rates on the markets and expects a potential stock market decline as a result. Additionally, Grantham predicts moderately higher inflation and interest rates going forward.